For healthcare providers, a patient’s health insurance card is more than just identification. It is the key to accurate billing, swift claims processing, and ensuring seamless patient care. Every insurance card contains important information about coverage, payers, plan types, and patient eligibility, but the layout and details can vary widely from one insurer to another.

Misreading or overlooking crucial details on these cards can lead to denied claims, billing delays, and headaches for both staff and patients. By knowing exactly what to look for and how to interpret every section of a health insurance card, you can reduce errors, speed up patient intake, and keep the revenue cycle running smoothly.

In this guide, we will walk you through the key areas and best practices for interpreting insurance cards, so that as a provider, you don’t have to face troubles while reading the patient’s health insurance cards.

Key Takeaways

- The front of the card contains the member ID and plan type, which you must enter accurately to verify coverage and submit claims without delays.

- The back of the card provides the Payer ID and claims submission address, which are critical for sending claims to the correct insurance company electronically.

- You must always confirm the patient’s plan type (like HMO or PPO) to make sure your practice is in-network and to avoid claim denials and high costs for the patient.

- Understanding common terms like copay, deductible, and coinsurance helps you correctly calculate the patient’s financial responsibility right away.

How to Read Health Insurance Cards?

When you look at a health insurance card, you’ll notice it usually has two sides: the front and the back. Each side holds important information you need to know to verify coverage, process claims, and provide smooth patient care.

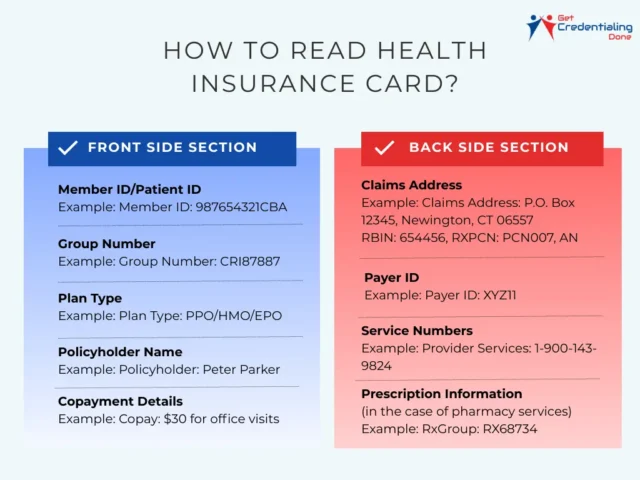

The image below shows a detailed overview of what you typically find on each side of a health insurance card, so you can quickly spot the details that matter most during patient intake or billing.

Front Section of the Insurance Card

The front side of a health insurance card includes several key pieces of information that you’ll want to pay close attention to:

- Policyholder Name: This identifies the individual who owns the insurance policy. It helps you determine if the patient is the primary insured or a dependent. For example, the name might read “Peter Parker”

- Member or Patient ID: This unique number is assigned to the insured individual and is critical when verifying coverage or submitting claims. Accuracy is essential here since even one incorrect digit can cause delays or denials. An example might look like “987654321CBA”

- Group Number: If the insurance is linked to an employer or other group, this number connects the patient to that specific group plan. It plays an important role in processing claims under the correct benefits. For instance, you may see a group number listed as “CRI87887.”

- Plan Type: This indicates the kind of insurance plan the patient has, such as HMO, PPO, or EPO. The plan type influences network access, required referrals, and cost-sharing details. A “PPO” plan, for example, generally offers more provider choice.

- Copayment Information: Often, the front lists fixed copayment amounts for common services like office visits or emergency room care. For example, it might say “$25 copay for office visits.”

Back Section of the Insurance Card

The back side of the health insurance card usually contains important information related to claims processing and customer support that you’ll need to keep handy:

- Claims Address: This is the mailing address where paper claims should be sent. Using the correct address is essential to avoid any delays in processing paperwork. For example, it might read “P.O. Box 12345, Newington, CT 06557”

- Payer ID: This alphanumeric code is used when submitting claims electronically and ensures they reach the right payer quickly and accurately. An example of a Payer ID might be “ XYZ11.”

- Customer Service Numbers: These phone numbers are provided for any questions about eligibility, billing issues, or general inquiries. Some cards list separate numbers for providers and members, such as “Provider Services: 1-900-143-9824.”

- Prescription Details: This section provides key info required for pharmacy claims, like the RxBIN, RxPCN, and RxGroup numbers, typically found under a section labeled “Pharmacy Benefits.”

How to Read Insurance Cards from Major Insurance Companies?

When working with patients, you’ll come across health insurance cards from many different companies. Although the designs and layouts may vary, the key pieces of information you need to verify coverage and process claims are always included.

Knowing where to find these details on each card helps you avoid errors and speeds up patient intake. In this section, we’ll take a closer look at insurance cards from four major providers like Aetna, Cigna, UnitedHealthcare, and Blue Cross Blue Shield.

We’ll break down each card’s unique features and show you exactly what to check when you see these cards, so you can handle them quickly and confidently. While most cards share the same core information, some major insurers have unique features or layouts that are helpful to know.

Medicare Cards

Medicare cards are distinct because they are issued by the government. The most important number on this card is the Medicare Beneficiary Identifier (MBI).

Unlike older cards that used Social Security Numbers, the MBI is a unique, 11-character combination of numbers and uppercase letters.

It doesn’t contain any personal information and is a crucial part of the government’s effort to prevent fraud. You must use this number for all Medicare-related claims and services.

Private Insurers

Large private insurance companies like Aetna, Cigna, UnitedHealthcare, and Blue Cross Blue Shield have their own specific card designs and terminology.

Aetna

On an Aetna card, in addition to your name and member ID, you will find the plan name (e.g., “Aetna Choice POS” or “Aetna Open Access”), which is important for providers to know your network type.

Aetna also uses specific Payer IDs for electronic claims, which might be listed on the back of the card, with common numbers like 60054 for claims.

UnitedHealthcare (UHC)

UHC cards are known for being very clear and easy to read. They often highlight key information like copay amounts for different services (e.g., “Primary Care Physician” vs. “Specialist”) right on the front.

This makes it simple for both you and your provider to understand your financial responsibility at a glance.

Cigna

Cigna cards typically include a Payer ID, often 62308, on the back, which is essential for electronic billing. They may also list different copay tiers for services like emergency room visits or mental health care.

Blue Cross Blue Shield (BCBS)

BCBS is a large network of independent companies, so card designs can vary by state. However, they almost always feature a three-character prefix in the Member ID number (e.g., XDP) that identifies the home plan.

This is critical for the BlueCard® program, which allows you to get in-network benefits when traveling or living in a different state.

Practical Steps for Providers

For healthcare providers and their staff, understanding a patient’s health insurance is a critical step in the billing process to ensure accurate claims and avoid delays. Here are the key steps for providers to follow.

Verifying member ID and key details

The first and most critical step is to verify the patient’s identity. Staff should cross-reference the patient’s name and date of birth from their photo ID with the information on the insurance card. This confirms the patient is the correct policyholder or a covered dependent.

The member ID and group number must be accurately entered into the billing system to prevent claim denials and ensure the patient’s record is correctly accessed.

Confirming payer and claims data

The Payer ID is a unique alphanumeric code assigned to each insurance company, and it is essential for electronic claims submission.

Providers must use the correct Payer ID, which is often found on the back of the card, to ensure the claim is routed to the right insurer. Using an incorrect ID is a common cause of billing errors and claim rejections.

Understanding plan type, network, and group number

The plan type (e.g., HMO, PPO) indicates how the patient can access care and if they need a referral to see a specialist.

Providers must check if they are “in-network” for the patient’s specific plan. Being “out-of-network” could result in higher costs for the patient and a claim that is denied or paid at a lower rate.

Reviewing coverage dates and benefits coordination

Providers should confirm that the patient’s policy is active on the date of service by checking the effective dates on the card.

Additionally, if the patient has more than one insurance plan (e.g., a primary and a secondary plan), the provider must understand the “coordination of benefits” rules.

This process determines which plan pays first and which pays second to avoid duplicate payments and ensure accurate billing.

Common Terms & How They Affect You?

Deductible: This is the amount you have to pay out of your own pocket for medical services before your insurance company starts to help. It’s like a set entry fee for your insurance to “kick in” for most services. For example, if your deductible is $2,000, you’ll pay for all your eligible healthcare costs until you’ve spent that amount.

Copay: This is a fixed amount you pay for a specific service, like a doctor’s visit or a prescription. You often pay this right at the time of the service. Copays are typically separate from your deductible. So even if you haven’t met your deductible yet, you might still only pay a small, fixed copay for a regular check-up.

Coinsurance: Once you’ve paid your full deductible, your insurance company starts to share the costs of your care with you. Coinsurance is your portion of that shared cost, and it’s calculated as a percentage.

For instance, if your coinsurance is 20%, you would pay 20% of the cost for a covered service, and your insurance would pay the remaining 80%. This continues until you reach your out-of-pocket maximum for the year.

FAQ

If a patient misplaces their Medicare card, you can guide them to:

1. Visit Medicare.gov to print a temporary card or request a mailed replacement.

2. Call **1-800-MEDICARE** (1-800-633-4227) to request help. Meanwhile, you can still verify their coverage using the Medicare Beneficiary Identifier (MBI) from their prior records. Remind them to share the new MBI as soon as they receive it to prevent claim issues.

The issuer is the entity that provides the insurance coverage—this could be a private insurer like Blue Cross Blue Shield or a government program like Medicare or Medicaid. Knowing the issuer ensures you route claims to the correct payer (e.g., Medicare claims go to the government, Aetna claims go to Aetna). Always double-check this information to avoid billing mistakes.

A **PCN (Processor Control Number)** is primarily used in pharmacy / prescription claims. It helps the insurer’s system route those claims properly under a patient’s plan. Medical providers often don’t need it, but pharmacists rely on it. If it isn’t displayed on the front of the card, check the back or contact the insurer for pharmacy details.

Start by verifying these: patient name, unique ID number (policy/member ID), issuer (e.g., Cigna, Medicare), group number if applicable, plan type (HMO, PPO, etc.), and the customer service or claims number. Also confirm the coverage dates are valid. If any detail seems off, ask the patient to verify with the insurance company.

The **group number** identifies the employer, union, or organization sponsoring the insurance plan. It helps insurers route claims correctly. Note: not all cards have a group number—plans like Medicare or individual policies often omit it. If present, always include it on claims to avoid delays.

The **policy ID** is your personal identifier (e.g. member number). The **plan number** refers to the specific benefits package chosen (e.g., “Gold” vs. “Basic”). Both are key to accurate claims. If your card shows both, use them.

Look for labels like “Group #” or “Group Number”—usually near the patient ID on the front or back. If you don’t see it, the patient’s plan might not include one (common in Medicare or individual plans). You can always ask the insurer or the patient’s employer to confirm.

No. Group numbers mainly exist for employer, union, or group plans. Government plans like Medicare, Medicaid, or personal policies generally do **not** include a group number. In those cases, you’ll rely on the patient’s ID number alone when billing.